|

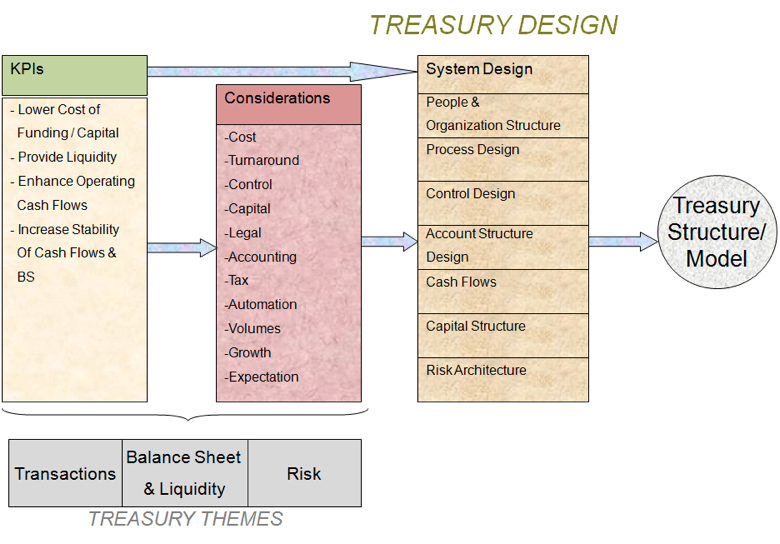

The concept of Treasury Design is simple – to organize the Treasury function, its people, processes and working from the purpose of efficiency, elegance and utility.

The starting point for Treasury Design are the Key Performance Indicators, since the existence of Treasury and its structure has the eventual goal of achieving these performance goals.

Since it is possible to have more than one route and model to achieve similar goals, other considerations come in to play to design an appropriately organized Treasury for the organization.

These considerations are:

- Lower Cost

- Lower Turnaround times for decision making and resolution

- Higher degrees of Control and wider net for control

- Lower cost of Capital and Increased availability and diversity of capital

- Legal environment of various locations

- Accounting practices followed by the firm and accounting environment of the geographies in which the business is being done

- Tax aspects of the same

- Automation required

- Existing and future volumes

- Growth and increase in business and geographies

- Expectation of turbulence of competitor and industry landscapes

The three Treasury themes or functions, namely the management of Transactions. Balance sheet & Liquidity and Risk, are the foundation for these KPIs and considerations.

The figure shows the development of the Treasury Design process, some of which are described below:

System Design

The importance of systems and technology and their role in Treasury has been introduced earlier. System design has to be done keeping in mind various aspects and considerations.

People and Organizational Structure design

This entails identifying the right people, equipping them with the right skills and putting them in the right jobs with the right reporting line. This is also linked to the decision of the degree of centralization and outsourcing.

Process Design

Based on creating watertight processes with controlled and measurable hand-offs, the process is the bulwark of the Treasury function.

Control Design

A strong control element is a safeguard against potential hazards and situations around implementation and execution. Even if the rest of the Treasury design elements are put in place, a weak control design element will not help in sustaining the strength of the implemented Treasury design and processes.

Account structure design

Covered in more detail in the Handbook, designing the right account structure is an often under-rated element, with ad hoc account creation that can result in increase cost, lower control and poor visibility and utilization of cash. In some countries, regulatory conditions could also force the decision on Account structure.

Cash flow design

Cash flows can occur across locations, in various forms and currencies at different times. Consolidating and concentrating these flows creates greater efficiencies through reduced cost, increase control and better visibility of flows.

Capital structure

One of the Treasurer’s key areas of delivery is ensuring that the firm is adequately capitalized, and the price that the firm pays for the capital is the lowest in the circumstances. Capital structure also has a bearing on the credit rating and financial perception and performance of the firm, making it one of the critical areas evaluated by potential investors and lenders.

Risk Architecture

The last, but one of the most critical components of Treasury Design, Risk determines the firm's longevity and susceptibility to global market environments.

| Copyright Aktrea Capital, 2012 | Home | Terms | Privacy |